RAIN.CREDIT.

- Dapatkan link

- X

- Aplikasi Lainnya

RAIN.CREDIT.

INTRODUCTION

The deficiencies associated with the operations of banks and other financial houses have led to the development of various Defi and blockchain technology. These Defi platforms provide financial services that help people to build their wealth by depositing their assets for interest and provision of loan to borrowers. The lending and borrowing activities in the Defi have not been fully monitored, resulting to many defaults and restricted access to loans by genuine borrowers.

Rain.credit is a platform developed to conduct proper checks on the lending and borrowing activities of Defi. It uses the Oracle aggregator to provide off-chain analysis of a borrower in order to provide the eligibility status of the borrower. This help to reduce the exposure of the investors in their ecosystem. It uses a RAIN crypto token which is a BEP20 based on Binance Smart Chain.

These measures will be available for and provided freely in the future to RAIN community members to enable them improve their activities.

The Rain.credit platform has a team of experts with years of experience in blockchain engineering, cryptosystem, customers relationship, interpersonal relationship and technology design innovations.

The Oracle Analytical Aggregate

This process provides solutions to various challenges encountered in Defi lending. It instills transparency, trust in both lenders and borrowers and reduces loss of assets resulting from default payments. It gives a review analysis of the users past transactions and repayment history which help in the amount of collateral required for a loan amount. Rain.Credit Oracle builds confidence in lending protocol and gives its users a unique experience.

RAIN.CREDIT will collaborate with sister Defi platforms, promoters, developers for the provision of off chain API interface services which will feature blacklist account tracker, smart contracts analysis, sharing AMM, investment advice etc.

Rain.Credit Oracle users who provided good information can lend a good percentage of provided collateral. Failure to liquidate the loan within stipulated time will limit the user's chances of getting another loan across Defi platforms subsequently.

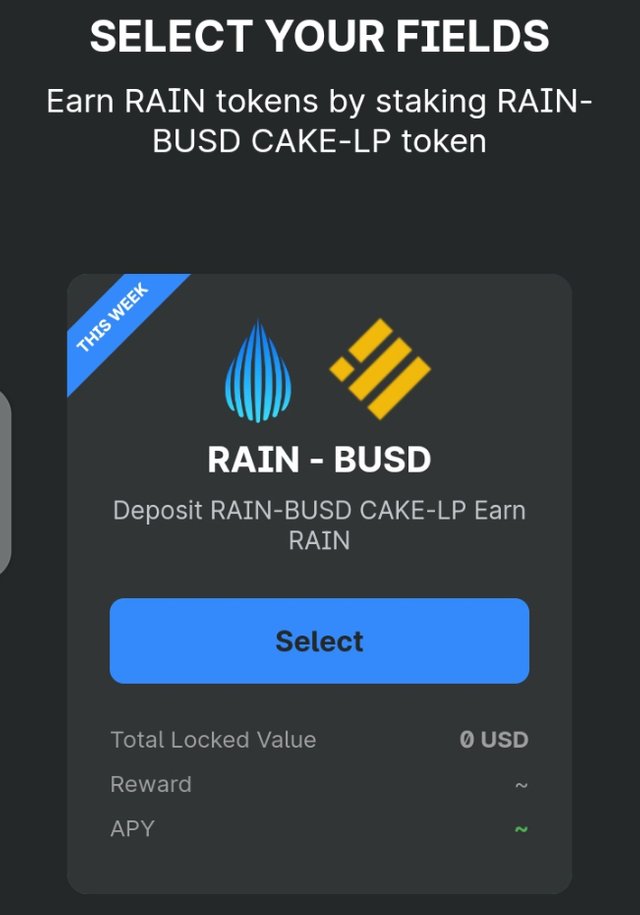

$RAIN TOKEN

The RAIN.CREDIT protocol will be operated with a basic crypto token - $RAIN token. The management projects 800,000 $RAIN tokens which will be distributed in the following percentages:

Presale - 40%

Project development - 20%

Mining and yield farming - 20%

Marketing activities - 10%

Management team ( locked for 2 years before distribution) - 10%

SUMMARY

RAIN. CREDIT is an unprecedented protocol that provides the opportunity to establish trust in the Defi ecosystem lending activities, by using off chain analysis to build confidence in the users before processing loans.

Its users don't need to worry about the credibility and other factors, rather they should focus on how to grow their wealth with the available assets.

WARNING

There are some risks associated with cryptocurrencies which users must consent to. Goldcoin as a cryptocurrency is not exempted from these risks. Thus, users are advised to consult legal and financial experts for professional advice before investing in Goldcoin.

The white paper and website contents are for information purposes and not advice for investment. Rain.credit will not be liable for any loss incurred by clients in the course of transactions on its platform.

RELATED LINKS

https://rain-credit.medium.com/

https://github.com/Rain-Credit/rain-bep20-contract

https://rain.credit/

WRITER DETAILS

Bitcointalk username: EEN 400

Bitcointalk link : https://bitcointalk.org/index.php?action=profile;u=3120889

Telegram username : @EEN400

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar