YEARNER FINACE

- Dapatkan link

- X

- Aplikasi Lainnya

YEARNER FINACE

Yearner is a complete interfacing join between different DeFi shows. What's considerably more critical, it's an association between you, the monetary supporter, and decentralized record – similarly as between Ethereum-based DeFi and other blockchains.

At the point when you store crypto in any of the Yearner Finance pools, you start obtaining a premium. That is the show's primary target: to help you obtain. Viably, without learning the complexities of DeFi and without moving your coins beginning with one phase then onto the following. Our count therefore finds the theory vehicle with the best return.

Yearner is the ultimate connecting link between different DeFi protocols. What's even more important, it's a link between you, the investor, and decentralized finance – as well as between Ethereum-based DeFi and other blockchains.

As soon as you deposit crypto in any of the Yearner Finance pools, you start earning an interest. That's the protocol's chief goal: to help you earn. Easily, without having to learn the intricacies of DeFi and without moving your coins from one platform to another. Our algorithm automatically finds the investment vehicle with the highest yield.

You can think of Yearner as an automated investment advisor that also does the investment for you. You're always in control of your money and can un-stake anytime. Plus, in addition to the yield of the investment vehicle itself, you'll get liquidity mining rewards in YFNR tokens. Your total APY can exceed 80%.

The yearn.finance stage involves a couple of free things, including:

APY – A data table that shows credit costs across different advancing shows.

Why Yearner Finance?

How to stake on Yearner Finance

Allow MetaMask to link to Yearner Finance when you open our website.

Deposit UNI-V2 tokens in the pool.

We execute the general thought of scattering liquidity among different exceptional yield shows that Yearn Finance led. Regardless, we added a couple of progressions :

Simper interface that even all out learners can use;

Improved organization to keep an essential separation from centralization;

Cross-chain maintain (not far-removed);

Higher prizes for participating in just;

More maintained shows (theory vehicles);

A security vault that moreover yields rewards;

Yearner Finance pools come without any time lock. You can claim the accumulated YFNR rewards and/or unstake your tokens whenever you like. Note that a 1% fee will apply to any tokens that are actively allocated in another protocol when you unstake them. At any moment, a certain share of the pool is idle; if the idle tokens are enough to complete your unstaking request, you won't be charged any fee. But if our system has to withdraw some tokens that are being actively invested and earning rewards, we'll have to withhold a fee.

Our advantages

Let’s take a quick look at what makes us stand out from other DeFi:

● Own Yield Farming Program: up to 100% annual payments in YFNR tokens;

● Reward for everyone: any pool member is eligible for a reward;

● Token management: YFNR token users can vote in polls expressing their own opinion on various Yearner Improvement Proposals;

● Intuitive UI: here users can stake and unstake assets or claim their rewards in a couple of clicks.

- Yield farming rewards:for every block on the Ethereum blockchain (roughly every 13 seconds), we distribute 10 YFNR. If you deposit at least $100 worth of crypto in any of the pools, you can expect to earn an annualized reward above 50% in YFNR tokens. If YFNR appreciates like most other DeFi tokens do, you overall yield farming profit will be above 100%.

- Uniswap trading fees:You probably know that the transaction fee on Uniswap is 0.3%, which is high compared to centralized exchanges, but these fees are distributed among liquidity providers. So as soon as you join any of our pools, you’ll start receiving your rewards. The more people trade, the more fees will be generated and the more you’ll earn. It’s hard to predict how high trading activity will be, but in many Uniswap pools users earn between 20% and 50% (annualized), and in some the profit reaches 100%.

- Token appreciation:When the price of a token you’ve deposited in a pool grows, you’re making a profit. Of course, you’d also get this profit if you just let the tokens lie idle in your wallet, but we still shouldn’t underestimate this effect. It’s this consideration that made us choose WETH and UNI for our pools — and, as the last few days showed, we were right.

YFNR Pre-Sale

From November 19 until the end of the month, we open a limited pre-sale of our project tokens.

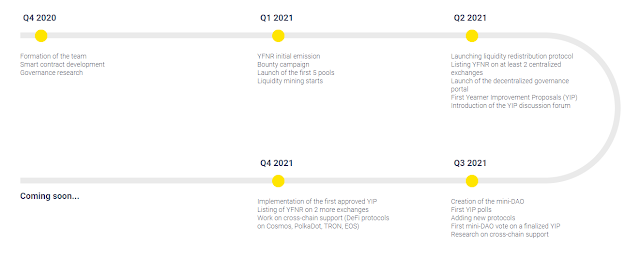

Roadmap

#Yearner, #YearnerFinance, #YFNR, #DeFi

For more information, please visit the links below:

Website: https://yearner.finance/

Telegram: https://t.me/YearnerFinance

Twitter: https://twitter.com/YearnerFinance

Instagram: https://www.instagram.com/yearnerfinance/

Discord: https://discord.gg/eYrwNZpnGt

YouTube: https://www.youtube.com/channel/UC6SX_fa5mN8PPJLWXWOTE8Q/featured

Facebook: https://www.facebook.com/YearnerFinance/

Joining the Bounty: https://yearner.finance/bounty

Bitcointalk Username: EEN 400

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=3120889

Eth Address: 0x7C22CE25152B07Db23B32FC8C36711be90d86181

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar